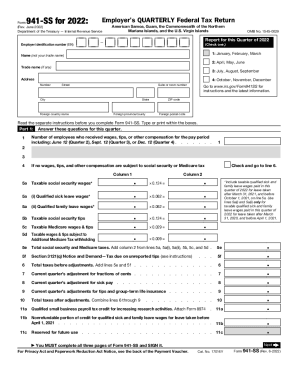

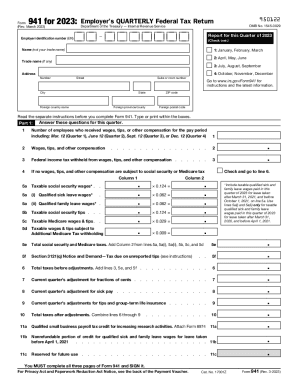

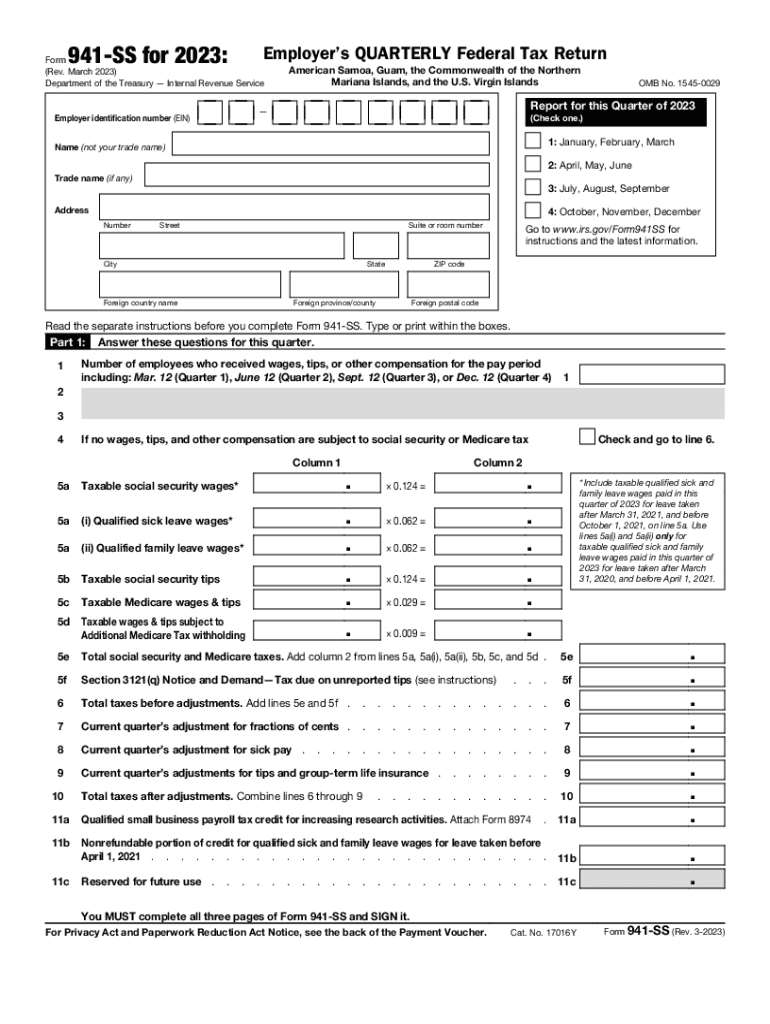

IRS 941-SS 2023-2026 free printable template

Instructions and Help about IRS 941-SS

How to edit IRS 941-SS

How to fill out IRS 941-SS

Latest updates to IRS 941-SS

All You Need to Know About IRS 941-SS

What is IRS 941-SS?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

What are the penalties for not issuing the form?

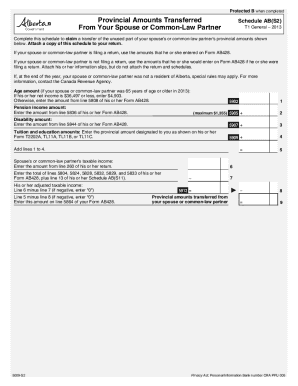

Is the form accompanied by other forms?

FAQ about IRS 941-SS

What should I do if I realize I made a mistake on my IRS 941-SS after filing?

If you need to correct an error on your IRS 941-SS, you should file an amended return using Form 941-X. Ensure to clearly indicate the specific corrections being made and provide an explanation for the changes. This will help the IRS process your amendments and update your account accordingly.

How can I track the status of my IRS 941-SS submission?

To track the status of your IRS 941-SS filing, you can use the IRS 'Where's My Refund?' tool if you've filed electronically. For paper filings, tracking is not available, but you can contact the IRS directly for updates on your submission. Be prepared to provide your employer identification number (EIN) and filing details.

What privacy measures should I take when filing the IRS 941-SS electronically?

When filing your IRS 941-SS electronically, it’s important to ensure that you use secure platforms that are IRS-approved. Always look for features like encryption and secure logins to protect your sensitive information. Additionally, be mindful of data retention practices and store any confirmations or documents securely.

What are common reasons for the rejection of my electronic IRS 941-SS filing?

Common reasons for rejection of an electronic IRS 941-SS filing include incorrect EIN, mismatched names, or mathematical errors. Carefully review your submission for accuracy before resending, and consult IRS guidelines or your software’s help resources for specific rejection codes and resolutions.

See what our users say