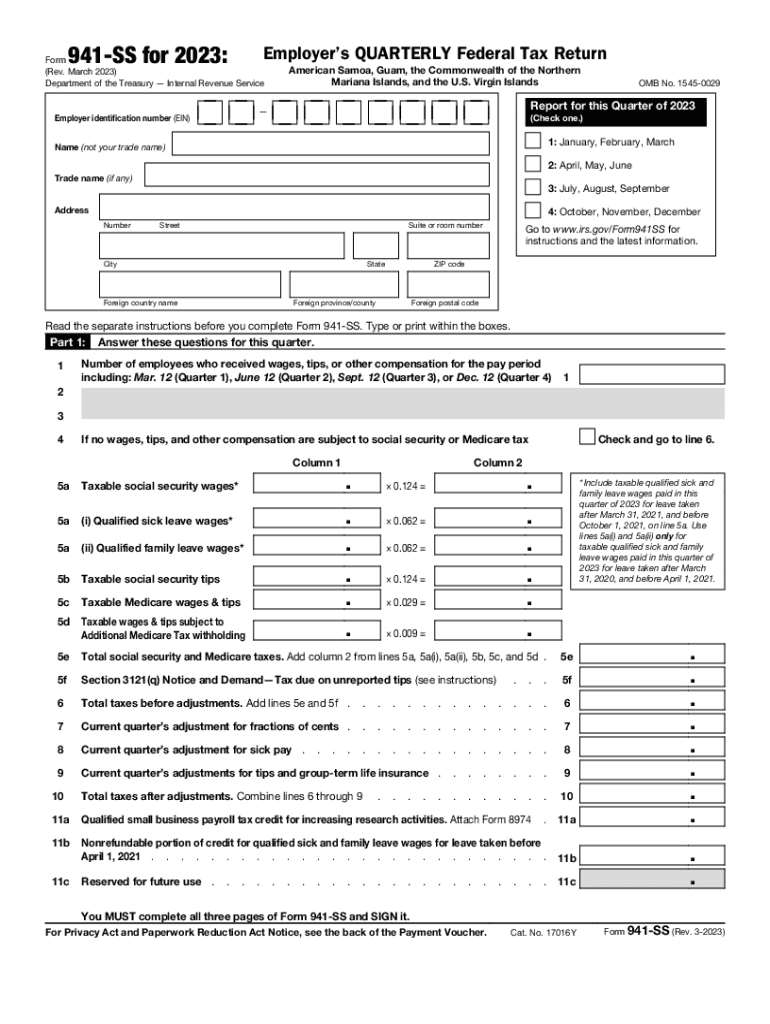

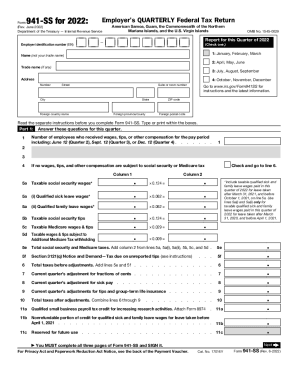

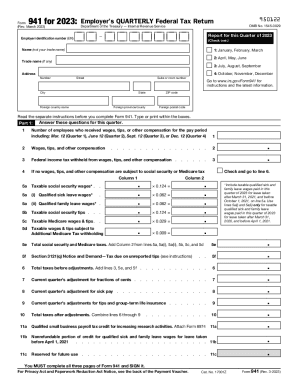

What is Form 941-SS 2024?

Form 941 (Employer Quarterly Tax Return) is an analog of Form 941 that reports social security and Medicare taxes for people employed in the USA. Form 941-SS serves the same purpose in unincorporated US territories. So the form tells the IRS the amount of money withheld in federal income tax and Medicare taxes.

Who should file Form 941-SS 2024?

The USA has some unincorporated territories overseas that still follow U.S. law. These territories include American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, and the U.S. Virgin Islands. Therefore, all tax documentation used on the mainland is valid for these territories. Form 941-SS applies in this case. The Employer’s Quarterly Federal Tax Return is created for employers who operate a business with employees in the above-mentioned US territories.

Is Form 941-SS accompanied by other forms?

Form 941-SS isn’t accompanied by other documents, but some forms might be helpful when completing it. Take a look at the list of these forms on the IRS website.

What information do you need to file Form 941-SS?

Form 941-SS consists of five parts and a payment voucher. In the form, provide your organization’s details, information on your employees’ wages and compensations subject to social security or Medicare tax, and other adjustments. Many calculations are on the form, but not all the lines are required depending on the employer’s financial situation. The minimum information required is the business and trade name and contact information. Read the IRS’s instructions for Form 941-SS to ensure that you enter the correct information.

How do I fill out Form 941-SS in 2025?

Before filling out the form for the respective quarter, make sure to learn the most recent updates related to Form 941-SS on the IRS official website.

Form 941-SS can be signed and filed electronically. Follow these steps to eFile your Form 941-SS with pdfFiller:

- Start by clicking Get Form.

- Complete the required fields by clicking on them and entering text.

- Click Sign in the top toolbar > Add New Signature > select the signing method and place the signature box in the desired location.

- Review Form 941-SS and hit DONE in the top right corner. Now you can choose to download, email, or send via USPS, etc.

If you print out and mail the form, make sure to select the correct 941 Form mailing address.

When is Form 941-SS due?

As the name (Form 941 Employer Quarterly Tax Return) implies, the form is due every quarter. The deadline falls on the last day of the month that follows the end of the quarter. Start filling the document in the quarter when the first wages were paid.

Where do I send Form 941-SS?

Make sure to verify and choose the correct 941 Form mailing address if you file it by mail. Mailing addresses differ depending on whether you attach a payment voucher to the form or not. The IRS website has a complete list of addresses for form submission. Please note, to save time, you can file the 941-SS Form electronically as well.